north dakota sales tax nexus

Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax. North Dakotas economic nexus threshold is gross sales into North Dakota exceeding 100000 in the previous or current calendar year.

North Dakota Sales Tax Quick Reference Guide Avalara

North Dakota enacted economic nexus legislation applicable to remote sellers who will be required to collect and remit North Dakota sales or use tax if the sellers gross sales or number of transactions surpass a certain threshold.

. North Dakota imposes a sales tax on retail sales. The remote sellers gross revenue from sales of taxable goods or services delivered into. That it owed use tax a companion tax to the sales tax payments for purchases that North Dakota residents had made through Quill Corps catalogue.

The rate on farm machinery irrigation equipment farm machinery repair parts and new mobile homes was increased from 35 to 4. A marketplace facilitator exceeding the sales threshold must obtain a sales tax permit and begin collecting tax on sales during the following calendar year or beginning 60 days after the threshold is met whichever is earlier. Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in North Dakota.

Having a certain amount of economic activity in South Dakota could trigger nexus under Senate Bill 106 which creates a tax obligation for out-of-state sellers meeting one of the following criteria in the previous calendar year. North Dakota sales tax is comprised of 2 parts. Ohio considers a seller to have sales tax nexus if.

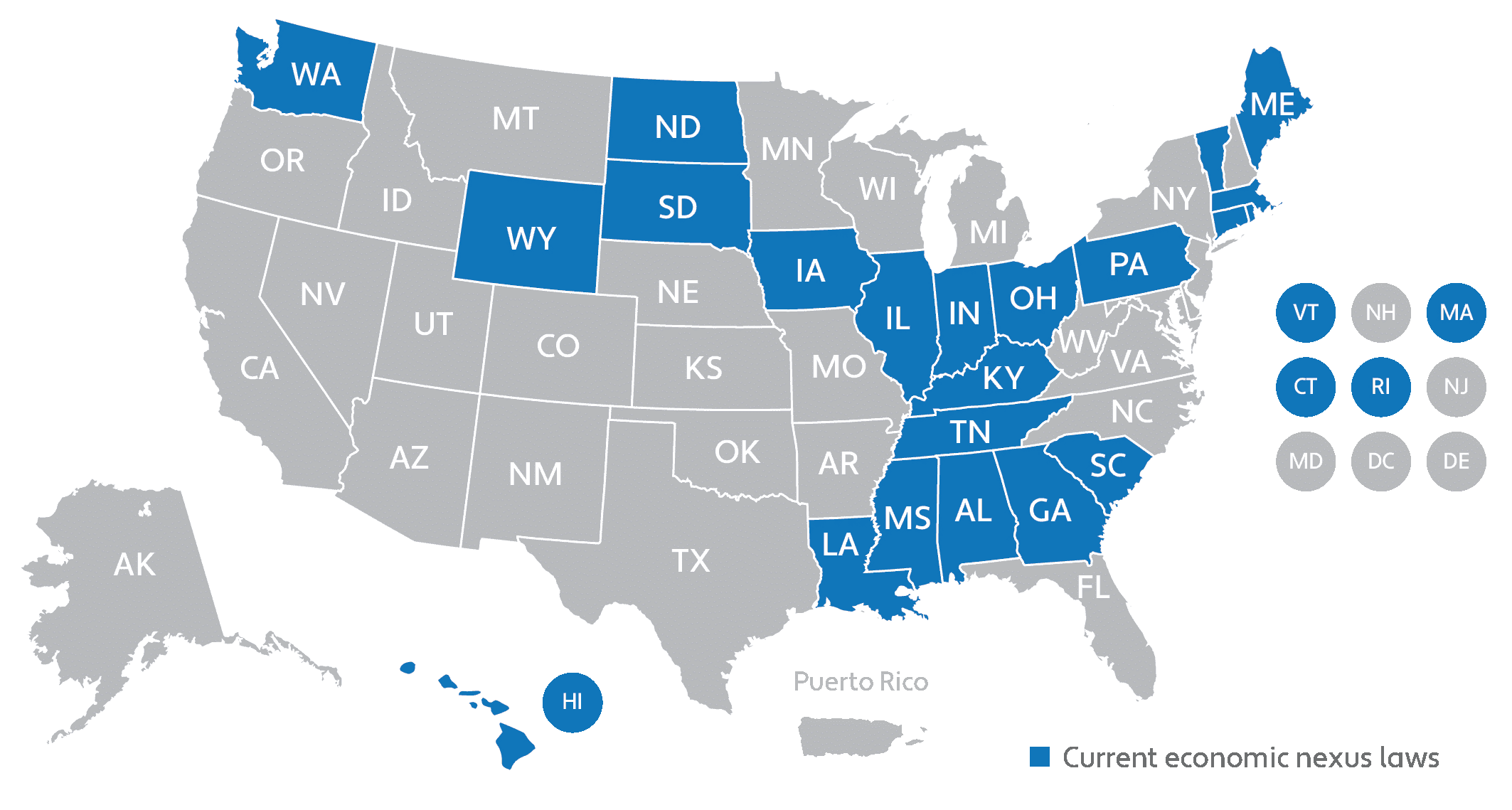

Most online sellers are by now familiar with the term sales tax nexus as defined in the Quill v. For more information see North Dakota Remote seller sales tax FAQ SB 2191 SB 2298. Economic nexus laws by state.

If you had 100000 or more in taxable sales in North Dakota in the previous or current calendar year then you are required to register for collect and pay sales tax to the state. Sales into North Dakota exceeding 100000 or sales were made in 200 or more separate transactions in the current or last calendar year. Supreme Court ruled in South Dakota vWayfair that sellers can be required to collect sales taxes in states where the sellers do not have physical presence overruling the 1992 case of Quill v.

Wayfair that sellers can be required to collect sales taxes in states where the sellers do not have physical presence overruling the Courts prior decision in Quill v. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021 are up 121 compared to the same timeframe in 2020. North Dakota sent a notice to Quill Corp.

Last updated November 29 2021. If you meet this threshold it does not matter if you have a physical presence in North Dakota. If a vendors transactions are determined to have nexus in South Dakota the vendor must register for a South Dakota sales.

We are updating Fact Sheets Industry Guides and Revenue Notices based on the courts decision and will post them on our website soon. The Maryland General Assemblys. And the rate on alcoholic beverages was increased from 65 to 7.

Prior to this ruling states could only enforce a tax collection obligation on businesses that had a physical presence in the state such as a brick-and-mortar location or remote employees. While the physical presence standard still exists nexus laws were expanded to include a sales tax. Retailers must have some kind of presence in a state before that state can require.

As of July 1st 2019 remote sellers with gross revenue of over 100000 are required to pay sales tax. Economic Nexus Threshold. Gross receipts tax is applied to sales of.

Marketplace facilitators with physical nexus in North Dakota are required to collect and remit sales and use tax. Economic nexus in North Dakota. The general sales and use tax rate and the motor vehicle excise tax rate was increased from 55 to 6.

Wednesday January 19 2022 - 1100 am. Yes North Dakota now has an economic nexus law. If a vendors transactions are determined to have nexus in North Dakota the vendor must register for a North Dakota sales.

If you have sales tax nexus in North Dakota youre required to register with the Office of State Tax Commissioner and to charge collect and remit the appropriate tax to the state. Businesses are required to register with the Ohio Department of Taxation and to charge collect and remit the appropriate tax when they have a physical presence in Ohio such as a retail store warehouse. South Dakota nexus for out-of-state sellers.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Common Ways to Have Sales Tax Nexus in North Dakota. Marketplace facilitators without physical nexus in North Dakota must have taxable sales exceeding 100000 in the.

Tax Commissioner Reports 121 Increase in 3rd Quarter 2021 Taxable Sales and Purchases. One of the more complicated aspects of South Dakota sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of South Dakota and is thus subject to state and possibly local sales taxes. The facts in Quill Corp.

The sales tax is paid by the purchaser and collected by the seller. Quill responded that it did not have nexus in North Dakota because it had no physical operations or employees. One of the more complicated aspects of North Dakota sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of North Dakota and is thus subject to state and possibly local sales taxes.

A marketplace facilitator is required to collect North Dakota sales and use taxes as well as local taxes on North Dakota sales made on its marketplace. Generally a business has nexus in North Dakota when it has a physical presence there such as a retail store warehouse inventory or the regular presence of traveling salespeople or. North Dakota Supreme Court case.

AND ITS IMPLICATIONS FOR SALES TAX NEXUS On June 21 2018 the United State Supreme Court ruled in South Dakota v. For the purposes of establishing a sales tax nexus in North Dakota the state interprets the phrase retailer maintaining a place of business in the state to include anyone engaged in solicitation of sales of taxable goods on a. Effective October 1 2018 North Dakota considers vendors who make more than 100000 in sales in the state in the previous or current calendar year to have economic nexus.

Ohio is an origin state. 52 rows North Carolina Economic Nexus North Dakota. This means the state considers these vendors obligated to collect sales tax from buyers in the state.

North Dakota Tax Nexus. For more information see the North Dakota DOTs remote sellers page here. On June 21 2018 the US.

North Dakota Sales Tax Small Business Guide Truic

Sales Tax Just Got A Lot More Complicated Are You Ready Teampay Teampay

Economic Nexus Laws By State Taxconnex

How To Register For A Sales Tax Permit In North Dakota Taxvalet

Redefining Online Sales Tax South Dakota Vs Wayfair And New Tax Compliance

Economic Nexus And The Future Of Sales Tax Avalara

Economic Nexus And The Future Of Sales Tax Avalara