san antonio property tax rate 2020

However the Texas legislature recently. The homestead exception -- a first of its kind in San Antonios history -- will slash 5000 off the appraised values of homes leading to decreased tax bills from the City.

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

This notice provides information about two tax rates used in adopting the current tax years tax rate.

. City of San Antonio. Buying a San Antonio rental property will bring you a good return on investment according to. San Antonio TX 78205.

Road and Flood Control Fund. The december 2020 total local sales tax rate was also 7. Most San Antonio City Council members seemed open to providing some form of residential property tax exemption.

The december 2020 total local sales tax rate was also 7. It shaves 001 which amounts to the 5000 minimum off the appraised. San Antonios fiscal 2020 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250.

In San Antonio the countys largest city and the second-largest city. Each unit then is given the tax it levied. San Antonio River Authority.

65 rows Discover what the 2020 tax rates and exemptions were. Jurors parking at the garage. The no-new-revenue tax rate would Impose the same amount of taxes as last.

The property tax rate for the city. Due to a change in the statue participating jurisdictions may elect to turn over their delinquent business property taxes to their delinquent tax attorneys for collection on April 1st of the year. Setting tax rates appraising property worth and then receiving the tax.

A delinquent tax incurs interest at the rate of 1 for the first month and an additional 1 for each month the tax remains delinquent. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. Rates will vary and will be posted upon arrival.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The FY 2020 Budget keeps property tax rate at 55827 cents per 100 valuation. Alamo Community College District.

The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. 65 rows San Antonio ISD. In addition to interest delinquent taxes incur the following.

San Antonio implemented its first homestead exemption the minimum allowed by the state in 2020. Overall there are three phases to real estate taxation namely. Bexar County collects on average 212 of a propertys assessed fair.

A San Antonio Rental Property Generates a Good Return on Investment. The property tax rate for the city. SAN ANTONIO June 16 2022 Today the San Antonio City Council unanimously approved new property tax relief measures that will bring relief to taxpayers this fall.

Debt Service Tax Rate Total Tax Rate.

San Antonio Property Tax Rates H David Ballinger

Largest Budget In San Antonio History Gives Smaller Percentage Of Funding To Police Fire Departments The Texan

Market Information Schertz Economic Development Corporation

Local Tax Rates And Exemptions 2018 Texas Cities San Antonio Report

League City Proposes Even Lower Property Tax Rate For Fy 2020 21 Community Impact

Frisco City Council Plans Same Property Tax Rate For Fy 2021 22 Community Impact

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

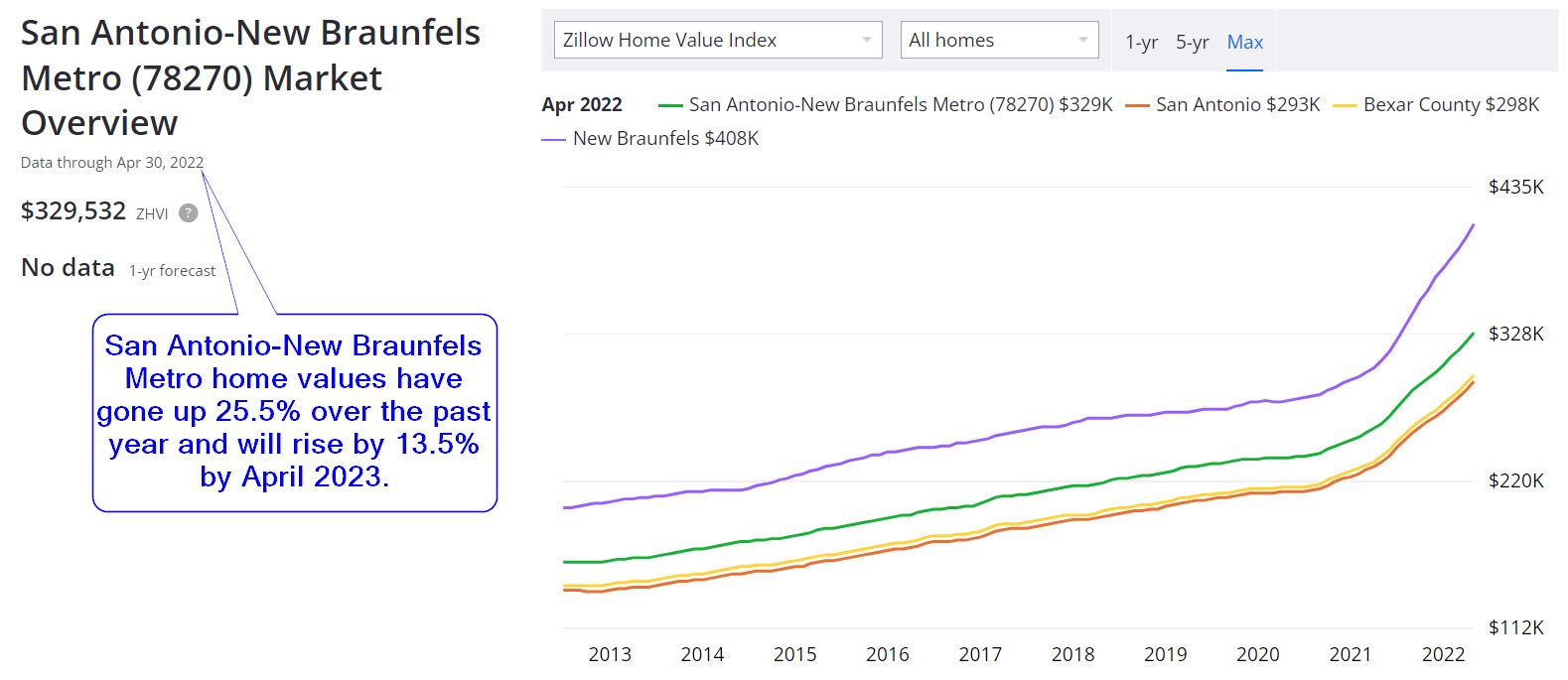

San Antonio Real Estate Market Prices Trends Forecast 2021 2022

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

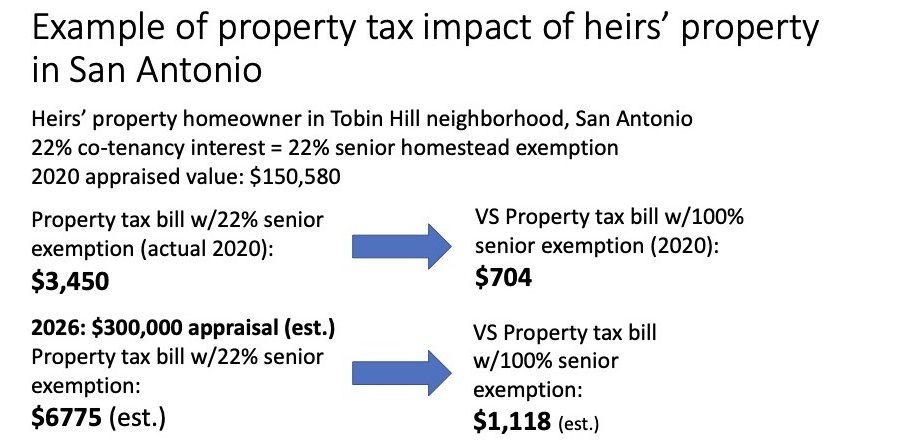

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

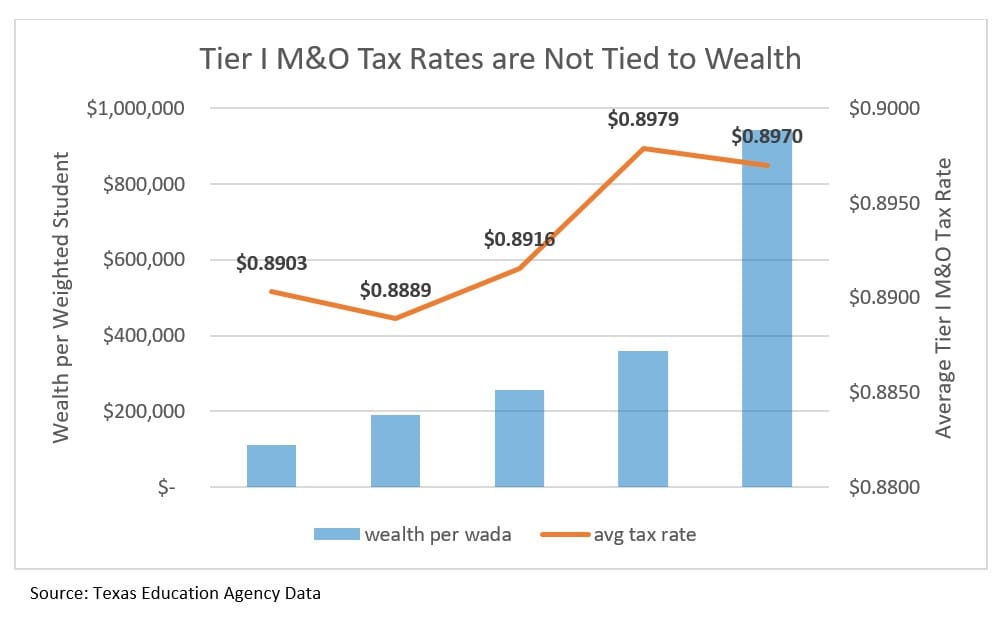

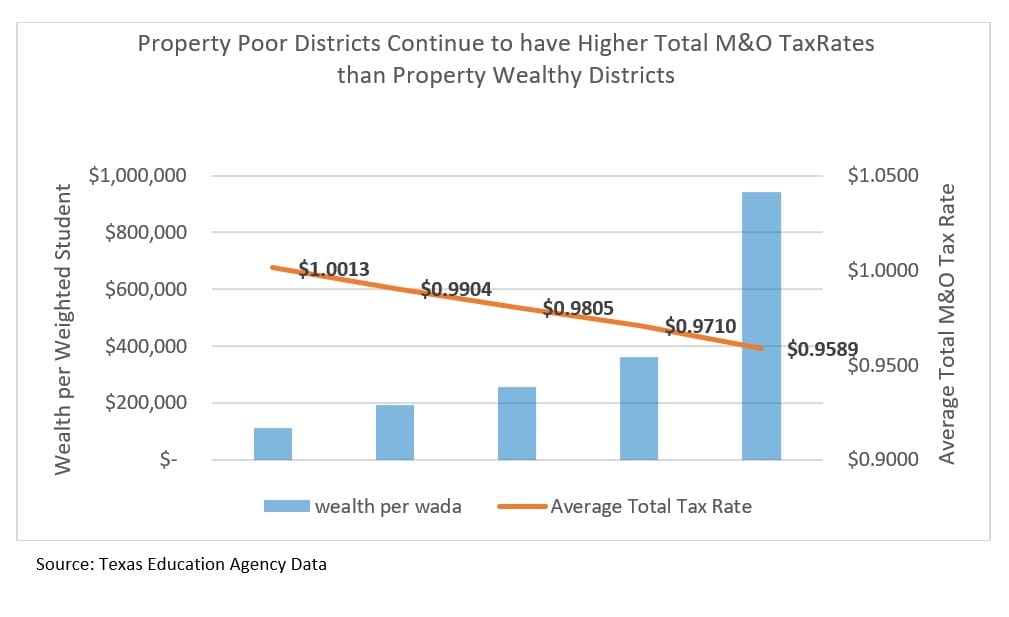

A New Division In School Finance Every Texan

Property Taxes By State How High Are Property Taxes In Your State

2022 Property Tax Rates Austin Tx Virtuance Real Estate Photography

Tax Breaks For Developers Under Scrutiny In San Antonio Texas Capitol San Antonio News San Antonio San Antonio Current